Image: “Stethoscope on Money” by George Hodan is licensed under CC0 Public Domain

The triple bottom line of running a business calls for including “people” and “planet” along with the traditional bottom line, “profit”.

A bit of back story first: I had a deadly, benign, slow-growing brain tumor that manifested symptoms back in late 1986. Dr. Tom Kenefick, MD, long may he wave, is the man who went into my cerebellum in July of 1987 and got it out. He saved my life.

Having medical insurance is what got me to him.

Without that insurance, I’m pretty sure I would be dead. Why? When I didn’t have medical insurance and presented to three different doctors in early 1987 with excruciating symptoms, they each dismissed me. “It’s all in your head,” said one. He was right, but not in the way he thought.

I’m still here because I finally did get medical insurance when I got a job with a big bank in June 1987. “Wait, what?” I can hear you wondering. “How’d she get a job when she was dying from an undiagnosed brain tumor?” Divine intervention. Seriously. And that’s a much longer story which I’m happy to go into at a later date.

Now this is where the term “pre-existing condition” comes in. I had just acquired one.

As long as I was an employee and worked for a company that provided medical insurance, I could get medical insurance. That’s because, then as now (and who knows for how much longer, but that’s another story), insurance companies could not exclude people with pre-existing conditions in group insurance plans. And could not charge them more for that coverage.

While the Patient Protection and Affordable Care Act—also known as the ACA, also known as Obama care, which went into effect January 1, 2014— mandates that insurers must cover all applicants regardless of pre-existing conditions and must charge them the same rates, that is not the reality on the ground.

Which brings me to my point here today.

The best option today still remains medical coverage tied to employment.

And here’s how your small business can get group coverage. It’s because of the rules around what constitutes a “group.”

And that’s just 2 or more full-time employees. And because one of those employees is the owner, all you need is one more employee and, voila! Your company is eligible for group insurance plans.

I can hear you now, “But that’s going to cost too much. My business can’t afford that.”

My response: There are costs and there are investments. Providing medical benefits is an investment in yourself and your employees.

There are ways to mitigate the cost. The lowest hanging fruit here is to have your employee pay all or part of the premium. Plus, you have many different plans to choose from, with different premiums and deductibles. That’s how to lessen the cost.

But that’s not the whole impact of providing medical insurance. You are more likely to be really clear about what you want in an employee before you hire that person, and you are more likely to vet that person. So this improves your bottom line by hiring smart the first time.

Also, an employee with benefits is more likely to stay with you, thereby increasing your bottom line. This is for three reasons: by not incurring costs associated with employee turnover, by increasing value inside the company with institutional memory, and by having employees that stay healthy, they are more productive.

So here’s the dealyo if you’ve got a small, owner-run business:

- Get yourself on payroll,

- Hire one other person and put them on payroll.

- Get a group coverage program.

- Have the employee pay up to 100% of the premium.

This is how you satisfy the “people” part of the triple bottom line, as well as the “profit” part.

Want some help figuring out exactly what your options are and how you can get this done? I can help you figure out how to design more equity into your business. Set up a Financial Clarity Call with me and we’ll nail this down.

Image: “Dollar Banknotes and Judge’s Gavel” by George Hodan is licensed under CC0 Public Domain

Image: “Dollar Banknotes and Judge’s Gavel” by George Hodan is licensed under CC0 Public Domain

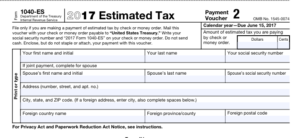

Self-employed? File a Schedule C with your 1040?

Self-employed? File a Schedule C with your 1040?