Self-employed? File a Schedule C with your 1040?

Self-employed? File a Schedule C with your 1040?

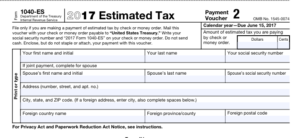

Then “heads up!” Second installment of 2017’s estimated tax payment’s due on June 15th, 2017

How do you figure out how much to pay?

There are two schools of thought about how much to pay and when. The IRS would like you to estimate your net income for the entire upcoming year, calculate the Self-employment (SE) tax and personal federal income tax on that projected amount, divide by four and pay in equal installments.

Not so much.

Here’s another way and the way I recommend: pay as you go. And, be careful, the due dates are wonky. The first is due the four months into the year, the same day as your prior year’s final taxes, the second is two months later, the third three months later, and the fourth four months later. Don’t ask me why, makes no sense to me.

The tax is based on your Net Operating Income from your Profit & Loss statement. The turnaround time is tight here to do it this way…just two weeks. This is yet another reason to stay on top of your bookkeeping.

A few things to keep in mind:

- This applies to you if your business is what the IRS calls a “pass-through” entity. Meaning that your personally pay the taxes, the business doesn’t. If you’re not on payroll and are a sole prop or have an LLC, then this applies to you.

- Medicare (MC) and Social Security (SS) taxes apply to 92.35% of your NOI, no the full 100%. This means the first 7.65% is not subject to SE tax

- No limit on taxable MC income, but SS maxes out at $127,200 for 2017. Don’t get me started on the inequities of this. I think there shouldn’t be a limit. But I’m not in Congress.

- What you are paying is a combination of self-employment tax and personal federal income tax, if the latter is applicable.

- It makes no never mind if you have zero taxable income or a loss on your personal tax return (form 1040), SE tax still has to be paid. So even if you not sure if you will owe personal federal income taxes for the year, pay your SE tax as you go.

- If you’re not clear on what your tax bracket is, go to last year’s tax return, form 1040. Divide the taxes your owed, line 56, into your adjusted gross income, line 38. That’s your tax bracket. Example, taxes owed: $5,690 divided into adjusted gross income: $50,006 = 11%. Use this percentage in your estimates for the current year.

Here’s an example of the numbers in action:

| Payment Period | Jan 1 – Mar 31 | Apr 1 – May 31 | June 1 – Aug 31 | Sept 1 – Dec 31 |

| Due Date | 4/15/17 | 6/15/17 | 9/15/17 | 1/16/18 |

| NOI from P&L | $10,500 | |||

| % exempt from tax | 7.65% | |||

| $ exempt from tax | -$803 | |||

| taxable amount | $9,697 | |||

| Medicare – 2.9% | $281 | |||

| Social Security – 12.4% | $1,202 | |||

| Your Fed tax bracket | $1,067 | |||

| total estimated tax due | $2,550 |

What if you haven’t paid your first installment for this year? Combine the first and second together and pay them both on the one voucher due 6/15/17.

Same concept goes for state taxes, if personal income taxes apply to you in your state.

Clear as mud? No worries, hit me up with any questions and I’ll be more than glad to answer them. I love to decode the complexities of the financial high priesthood for you.

Leave a Reply